We Buy Houses For Cash New York City Things To Know Before You Buy

Table of ContentsSome Of Sell Your House For Cash New York CityAn Unbiased View of Cash For Houses New York CityNot known Facts About We Buy Houses In New York CityIndicators on We Buy Houses For Cash New York City You Should Know

If the borrower later on has a hard time to make repayments on the home loan, the VA can discuss with the loan provider on the person's behalf. Certain lenders supply novice property buyers with benefits that are funded by the federal government - https://calendly.com/simplybo1dre/30min. For example, novice property buyers with reduced- to moderate-income levels might get gives or loans that do not call for payment as long as the customer stays in the home for a specific duration of time.5 years old. The acquisition does not require to be a traditional home for the individual to qualify as a new homebuyer, however it should be the person's major residence. It could be a houseboat that will be made use of as a home. The maximum amount that might be dispersed from the individual retirement account on a penalty-free basis for this objective is $10,000.

For wedded couples, the restriction uses individually to every spouse. This implies that the combined restriction for a married couple is $20,000. The interpretation of a newbie property buyer is not as simple as it seems. For instance, federal Housing and Urban Advancement company programs define a newbie buyer as somebody that hasn't possessed a home for 3 years before the purchase of a house.

5%. A 10% or 20% cash money deposit is an awesome obstacle, particularly for novice property buyers that do not have any type of home equity. The Federal Housing Authority (FHA) has actually been insuring finances to novice purchasers, to name a few, because 1934. At the time, the united state was a nation of renters. Mortgages were readily available only to one of the most deep-pocketed customers and were restricted to regarding fifty percent of the building's value.

The 6-Minute Rule for House Buyers New York

Having graduated from university a couple of years back, I didn't believe it was feasible to acquire a home with my impressive trainee lendings. Virginia Housing made it possible with a give. I could not believe these were readily available to newbie homebuyers without settlement."

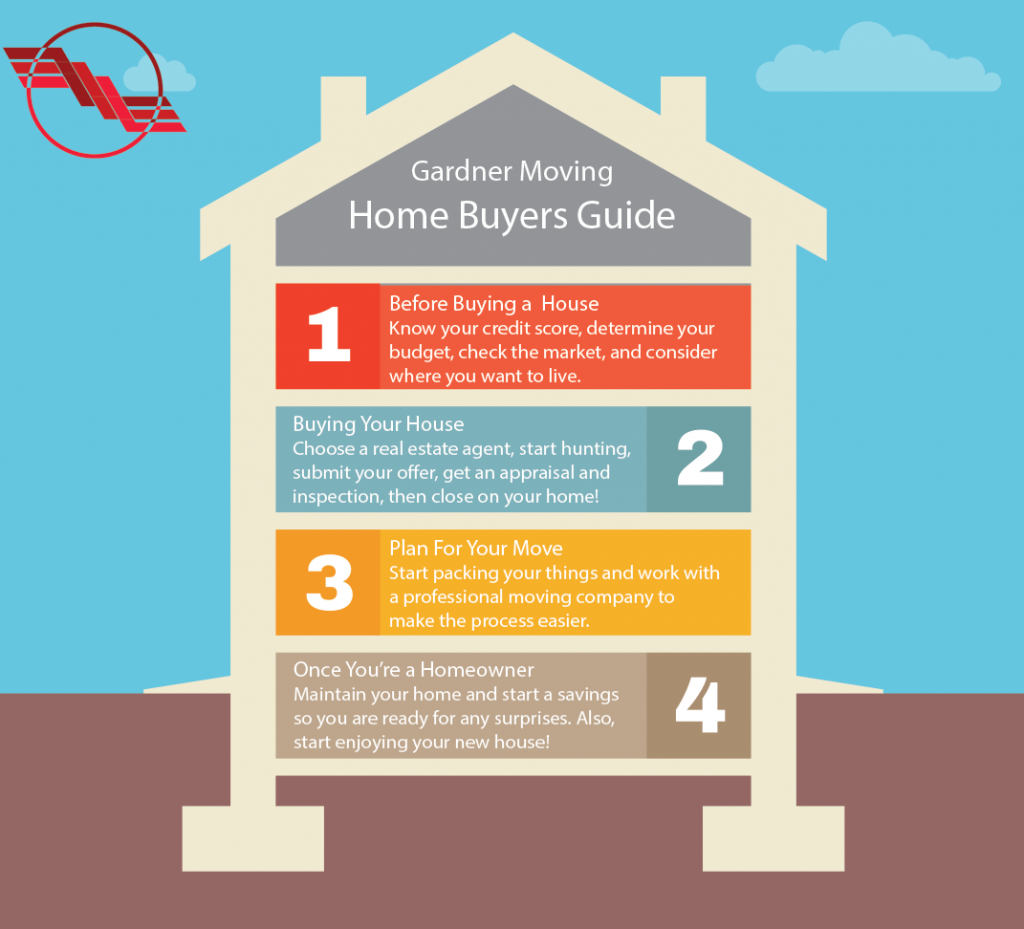

The following is a table of contents for the Home Buyers Handbook. Demands and Desires Checklist Discrimination and Fair Loaning Visit Open Houses Several Listing Solution (MLS) For Sale by Proprietor Publications Purchasing the Classifieds The Home Evaluation Making a Deal Comprehending the Acquisition Arrangement Arbitration Where Do You Locate a Lending institution? Resources for Low-Income Buyers Will You Required Home Mortgage Insurance Policy?

Homebuyer grants are created to offset some or all of the purchasing prices for first-time purchasers. They commonly cover component of a down repayment, closing costs, or occasionally, even the complete purchase cost of the home. They don't need repayment, as long as you live in your home for a needed duration of time.

The Best Strategy To Use For New York Home Buyers

federal government does not provide them directly. Instead, these funds are handed down to specific states, regions, and communities, which then create give programs for citizens within their jurisdictions. You have a number of choices if you're struggling to conserve up for a deposit, or if you're looking to decrease the costs of getting a home.

There are some vital details of the NHF grant: You have to utilize a taking part lending institution to certify. You have to have the ability to utilize it with any kind of car loan type, Federal Housing Management (FHA), Division of Veterans Matters (VA), U.S. Division of Farming (USDA), or conventional. You must reside in the home for at the very least three years.

They can vary, relying on the state in which you get. You might potentially be needed to take a property buyer education training course prior to declaring your credit rating. If you aren't acquiring for the initial time, you can still be eligible as long as you're acquiring a house in a HUD-approved area.

Not known Incorrect Statements About Sell My House New York City

VA and USDA car loans are home loan programs, not help programs, however both can assist you prevent needing a pricey deposit. You'll pay a 2% assurance charge with a USDA finance, but it can be rolled into your finance and spread throughout your month-to-month mortgage pop over to these guys repayments. VA fundings are offered just to military members and professionals.

Various give programs have various eligibility and application needs. It helps to begin by contacting your state firm for housing gives, which can connect you with neighborhood grant companies that can aid you with the application procedure (house buyers new york). From there, you can load out necessary applications and send your economic and background information to figure out if you qualify

You may have to fulfill specific ongoing demands to get approved for your give, but repayment isn't among them. Most gives only money a section of your home acquisition, so you will possibly still require a finance even if you get approved for a give.